Lest you think that last comment is some sort of hyperbole, let’s take a look at what Judge William M. Acker of the Northern District of Alabama, probably the lead singer in the Rising Judicial Chorus, had to say about remands in his recent decision in May v. AT&T Integrated Disability (case no. 11-AR-1923-S, 2013 WL 3879895) (July 26, 2013):

“Sophistic,” by that way, is sufficiently applicable to ERISA “insurers” that it ought to be part of their corporate name, something like “Sophistic Mutual ‘Insurance’ Company”: it means “plausible but fallacious,” which is pretty damn close to the high standard required for an “insurer’s” decision to pass inspection under a so-called “abuse of discretion” analysis.

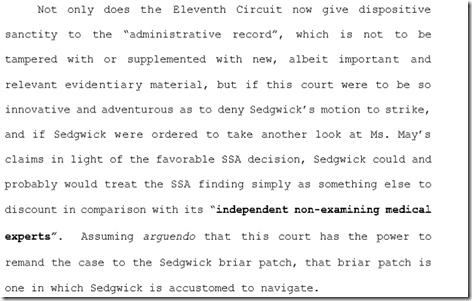

Judge Acker had quite a few other choice remarks about the Sophistic Mutuals of the world and the way the law renders them bulletproof. Here’s a taste:

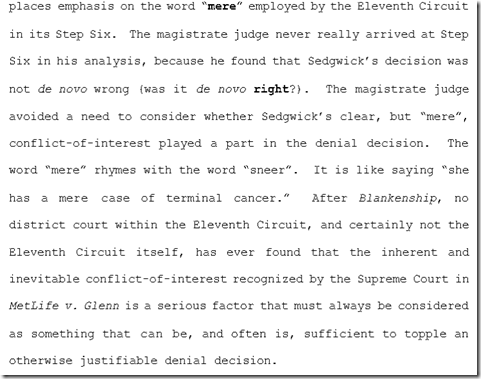

Or this, discussing how the Eleventh Circuit essentially discounts the very significant conflict of interest under which ERISA “insurers” operate:

And finally, a few choice words about the “abuse of discretion” rule as applied to ERISA “insurers”:

Bruch, you may recall, was the case where the Supreme Court first established this grant-of-discretion / abuse-of-discretion rule, a rule repeatedly abused by “insurers” in the manner described by Judge Acker. And he is quite correct about the due process implications — if only a court would ever take a serious look at them.

No comments:

Post a Comment